Everything You Need to Build a World-Class Retail Media Network

The Retail Media CloudTM is the ultimate SaaS platform for building retail media networks with ad serving that maximizes your share of advertiser budgets.

Launch high-impact ads that your brands will love in as little as 14 days.

Trusted by innovative brands around the world

Introducing

The Retail Media CloudTM

Built for Retailers, Marketplaces, and eCommerce

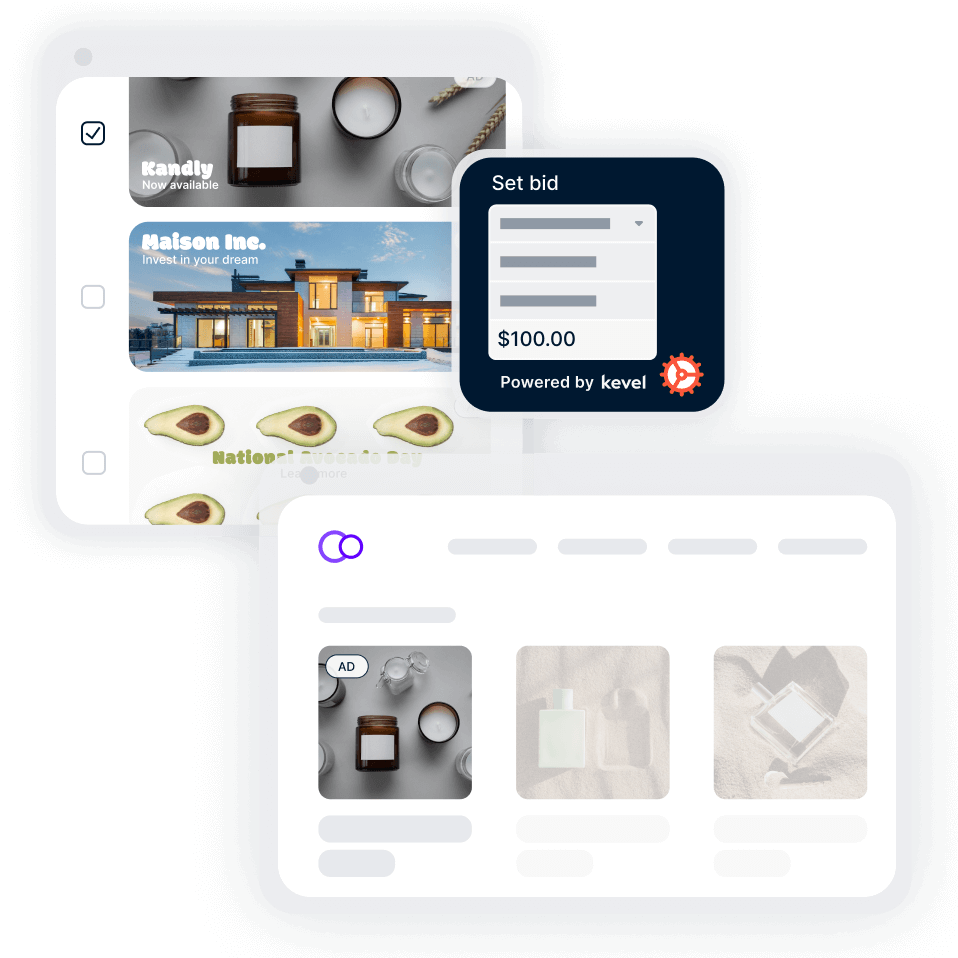

Powered by the Kevel Ad Server and Kevel Audience for launching targeted, attributable, customizable ad formats. Stand out to advertisers with your new, differentiated, custom retail media network.

OUTCOMES

Why Retailers Build on The Cloud

Make our tech your own. The Retail Media CloudTM provides all the resources you need to launch your custom retail media program.

Your ads, your way

API-first means you maintain total control of what ads appear on your site and who they are served to.

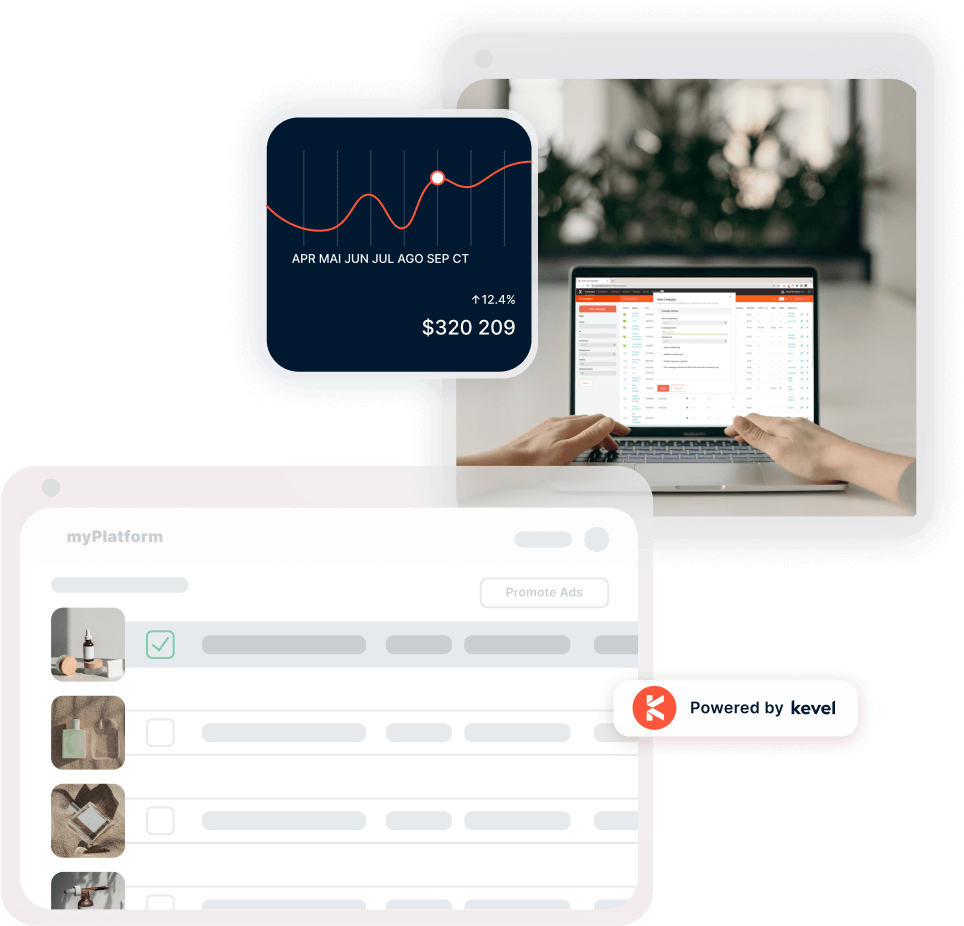

Revenue that stays in your pocket

We don’t punish you for growth–with SaaS pricing, you pay for tech, not performance.

Fast track your ad stack

Get to market faster with products that integrate seamlessly into your current stack.

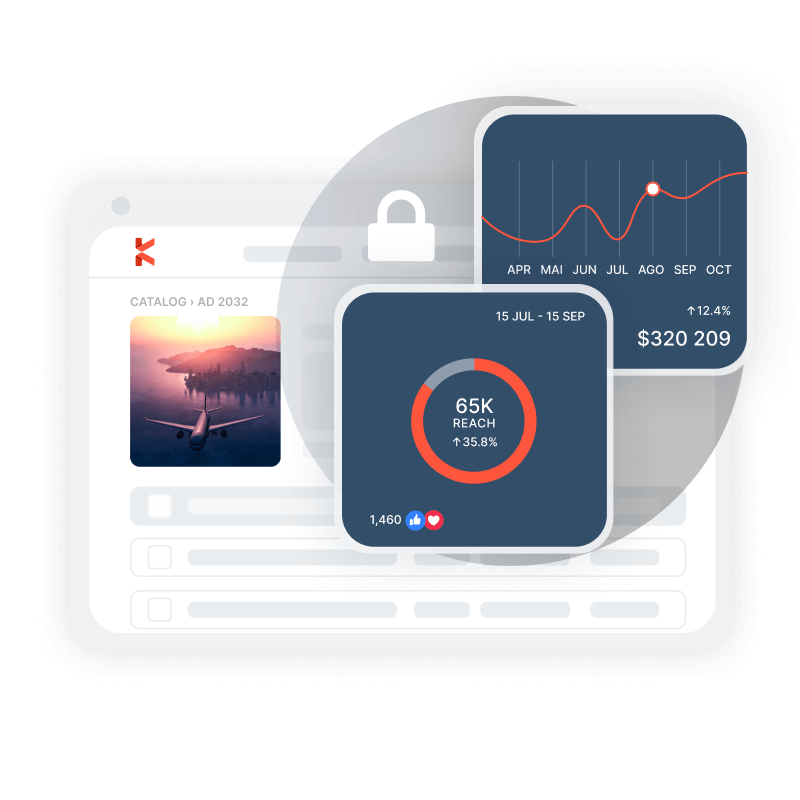

Safely Harness Your First-Party Data for Performance

We're a data processor. Use your own first-party data and ML models to launch user-level targeting without having to relinquish control or use black-box algorithms.

Don’t forfeit your data to use it

We never learn from your data or force our own data modeling on your unique network.

Soc 1 and 2 compliant

Industry-leading data compliance means top-of-line data security.

Bring your own ML model

We know you know your customers best–use your data confidently and securely.

Your ads, your way

API-first means you maintain total control of what ads appear on your site and to which audiences.

Fast track your ad stack

Get to market faster with products that integrate seamlessly into your current stack.

Revenue that stays in your pocket

We don’t punish you for growth–with SaaS pricing, you pay for tech, without a tax on your performance.

Soc 1 and 2 compliant

Industry-leading data compliance means top-of-line data security.

Don’t forfeit your data to use it

We never learn from your data or force our own data modeling on your unique network.

Bring your own ML models

You know your customers best. Use your own data confidently and securely.

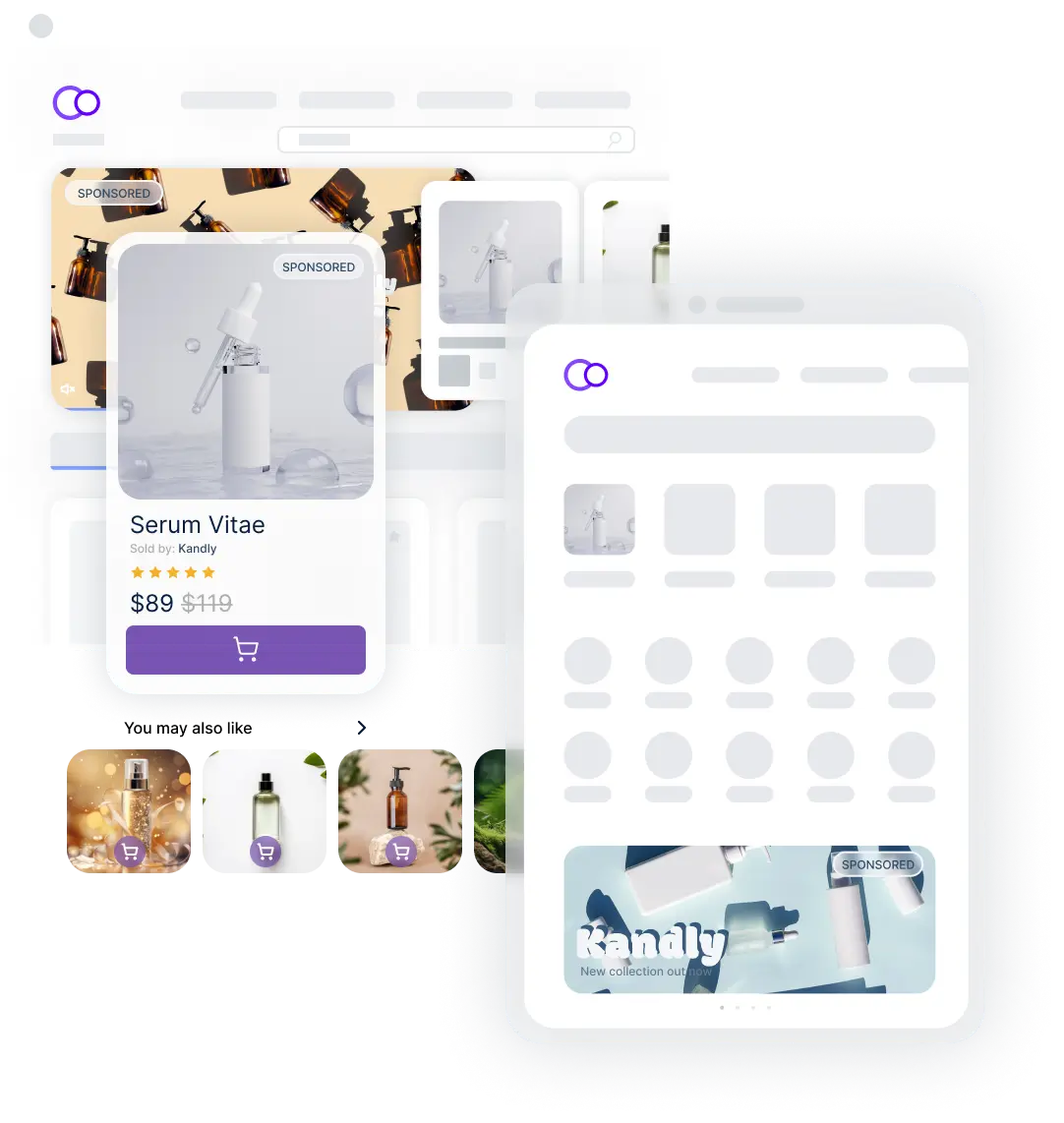

AD UNITS

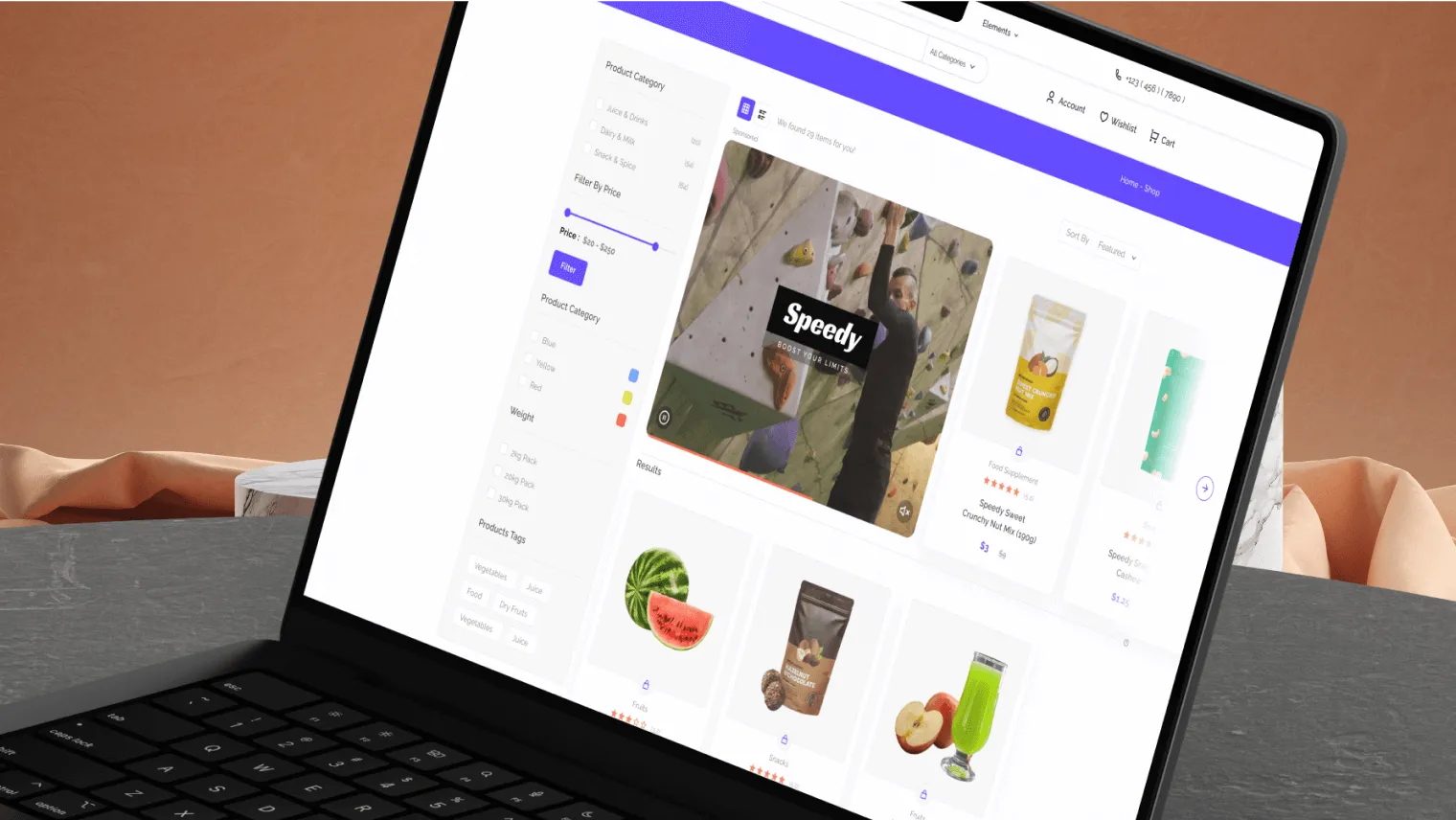

Build beyond traditional ad formats

Ditch the awkward white space. Create fast-loading, server-side ad units custom-built for your site and your shoppers.

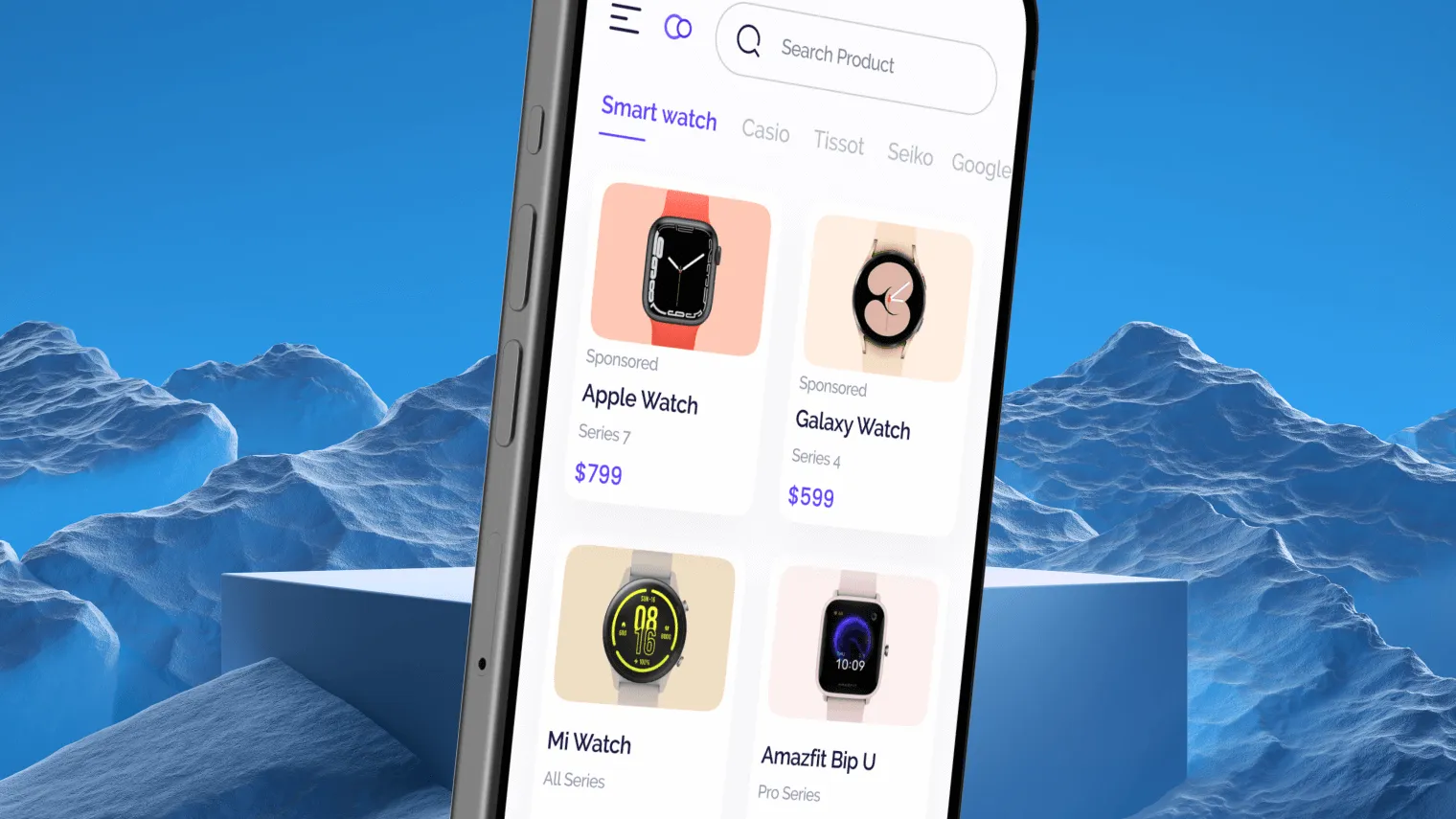

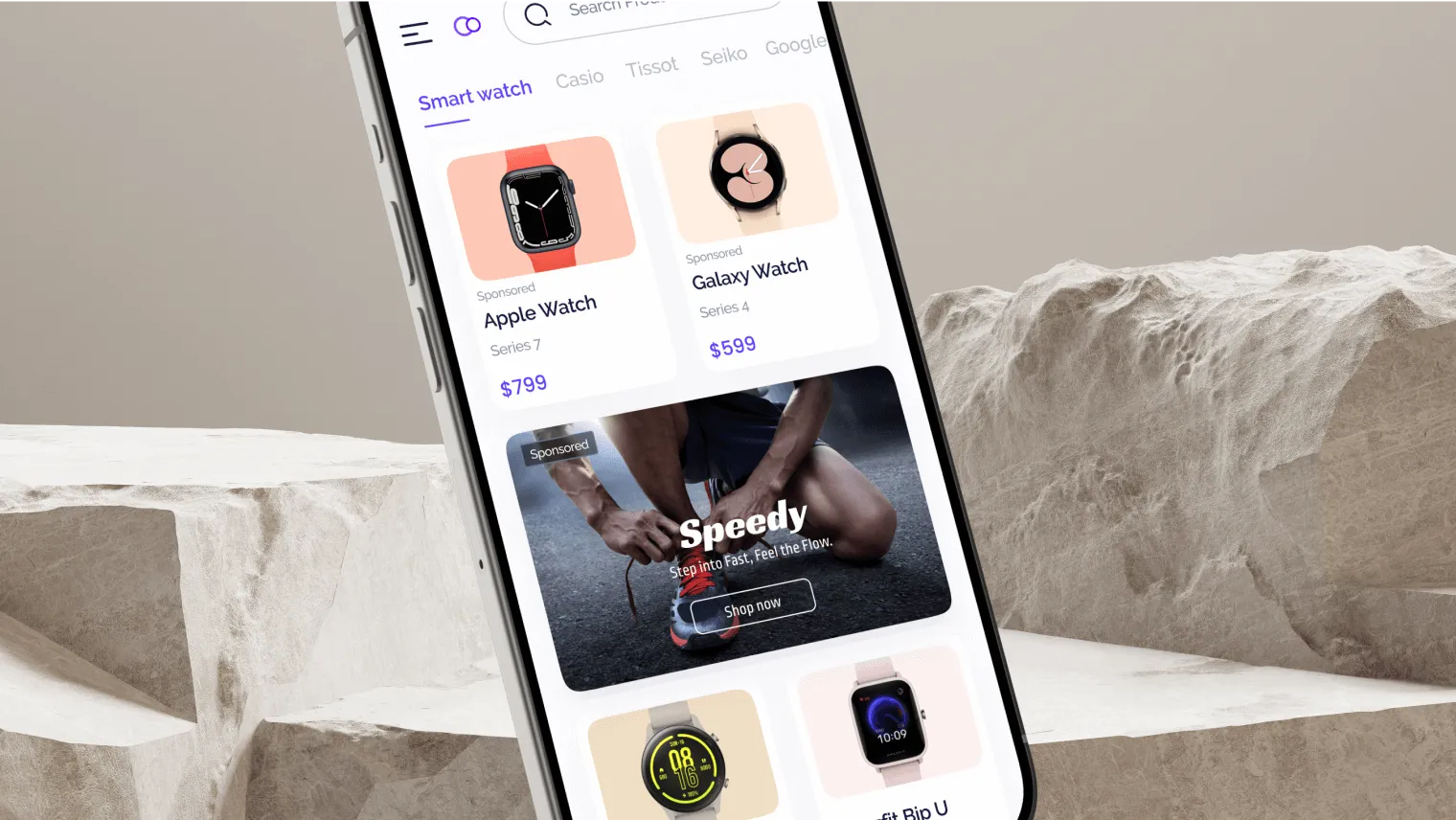

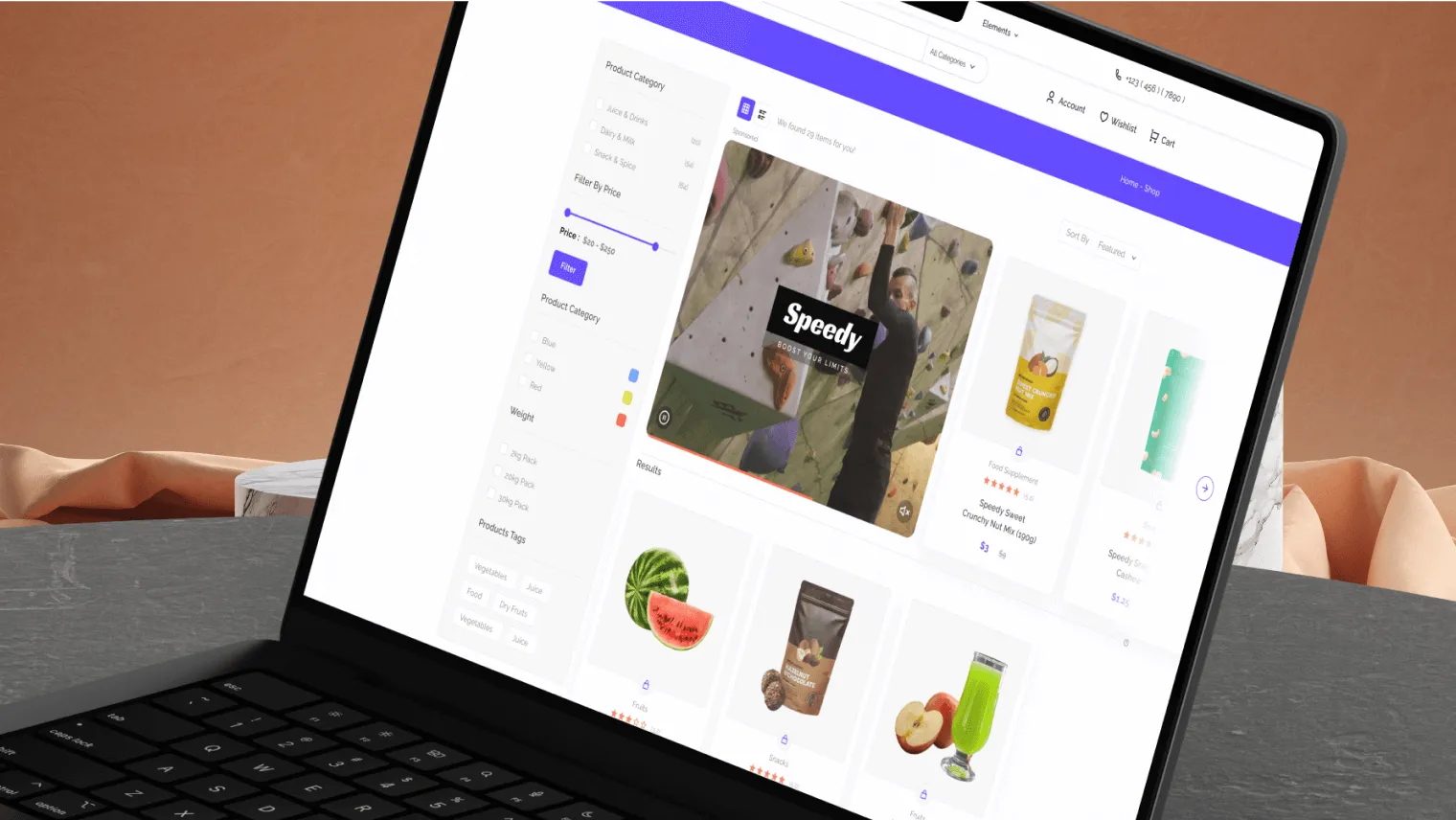

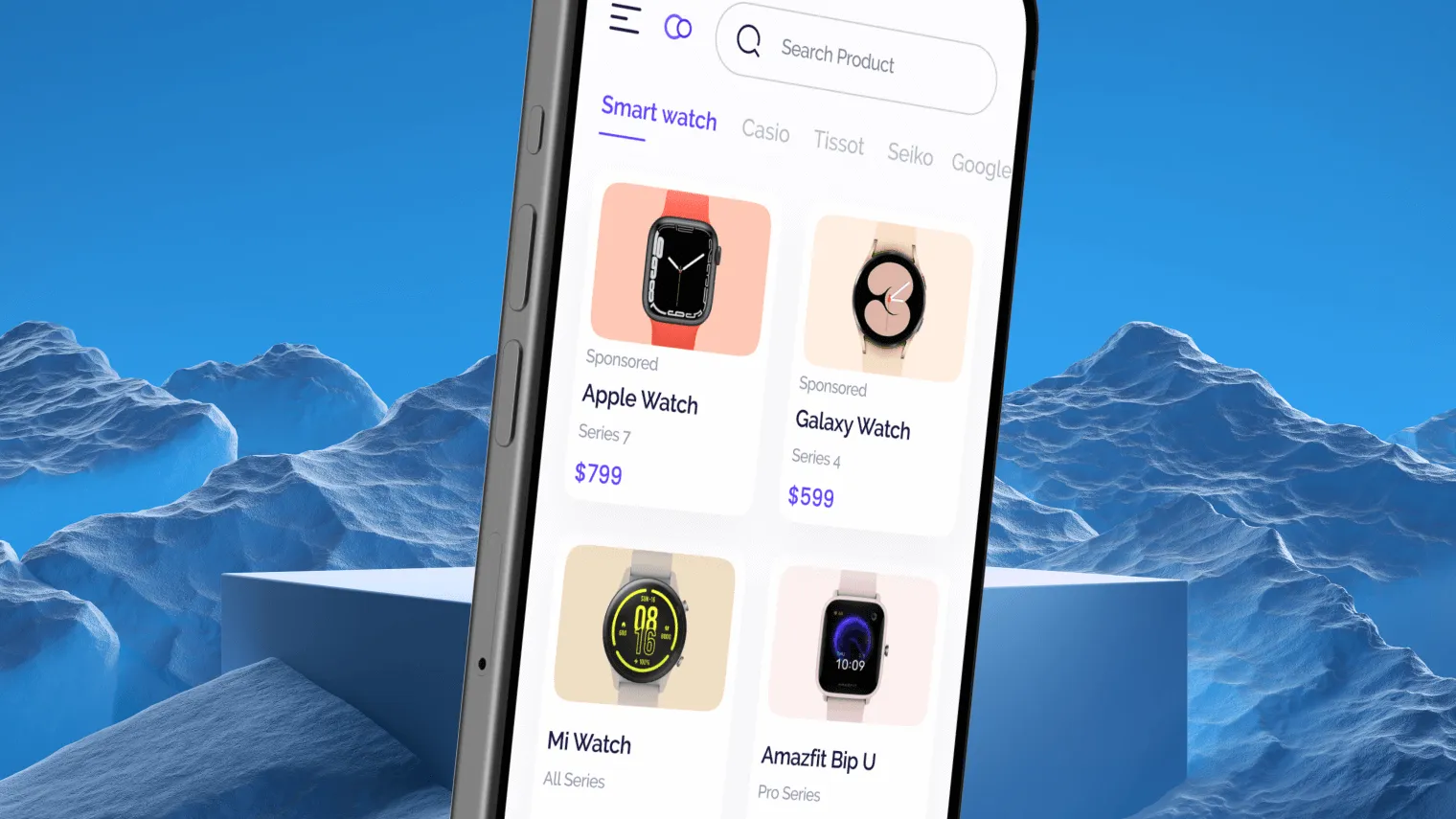

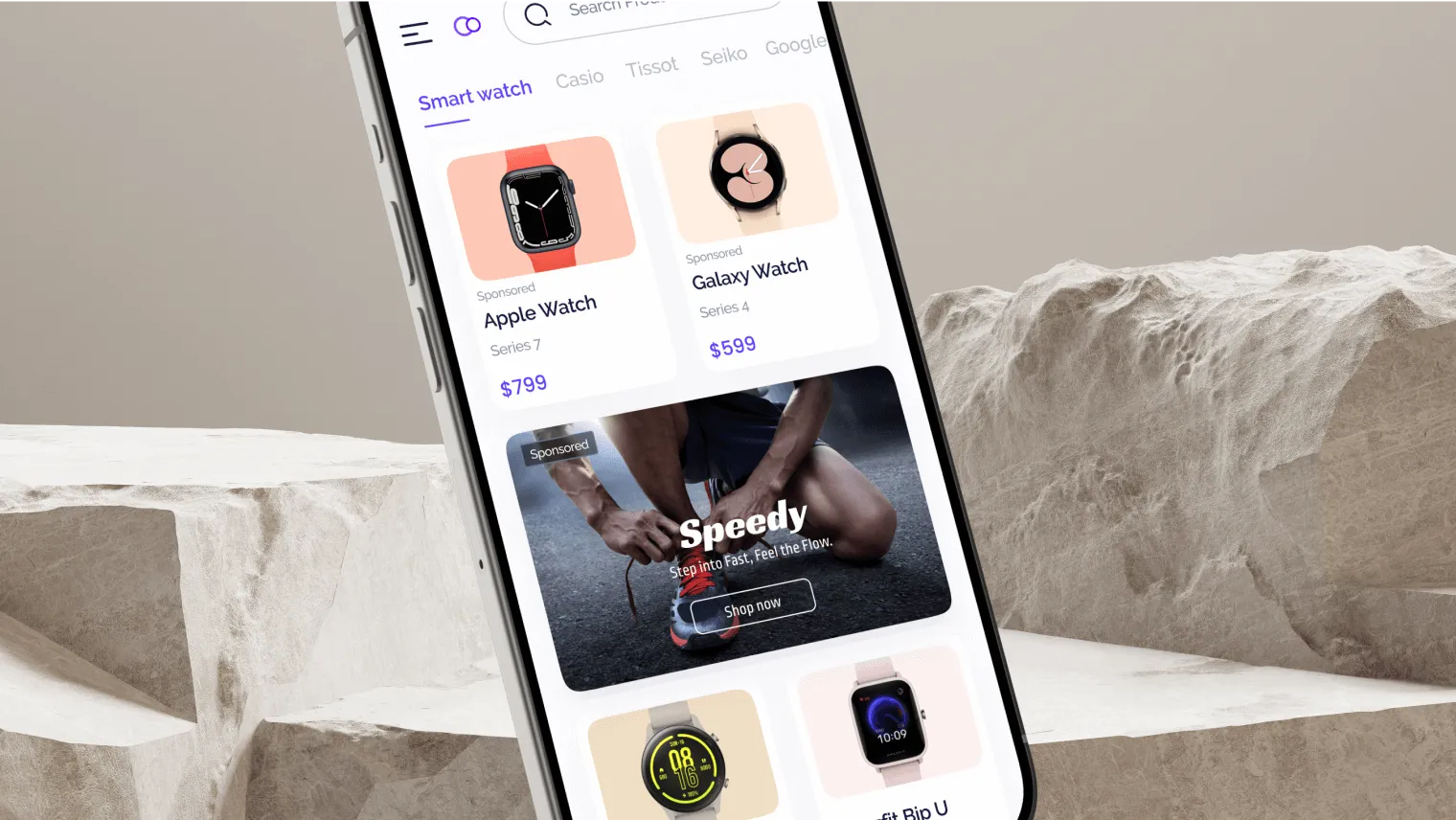

Sponsored Listings

Native Banner Companion

Video Sponsored Shelf

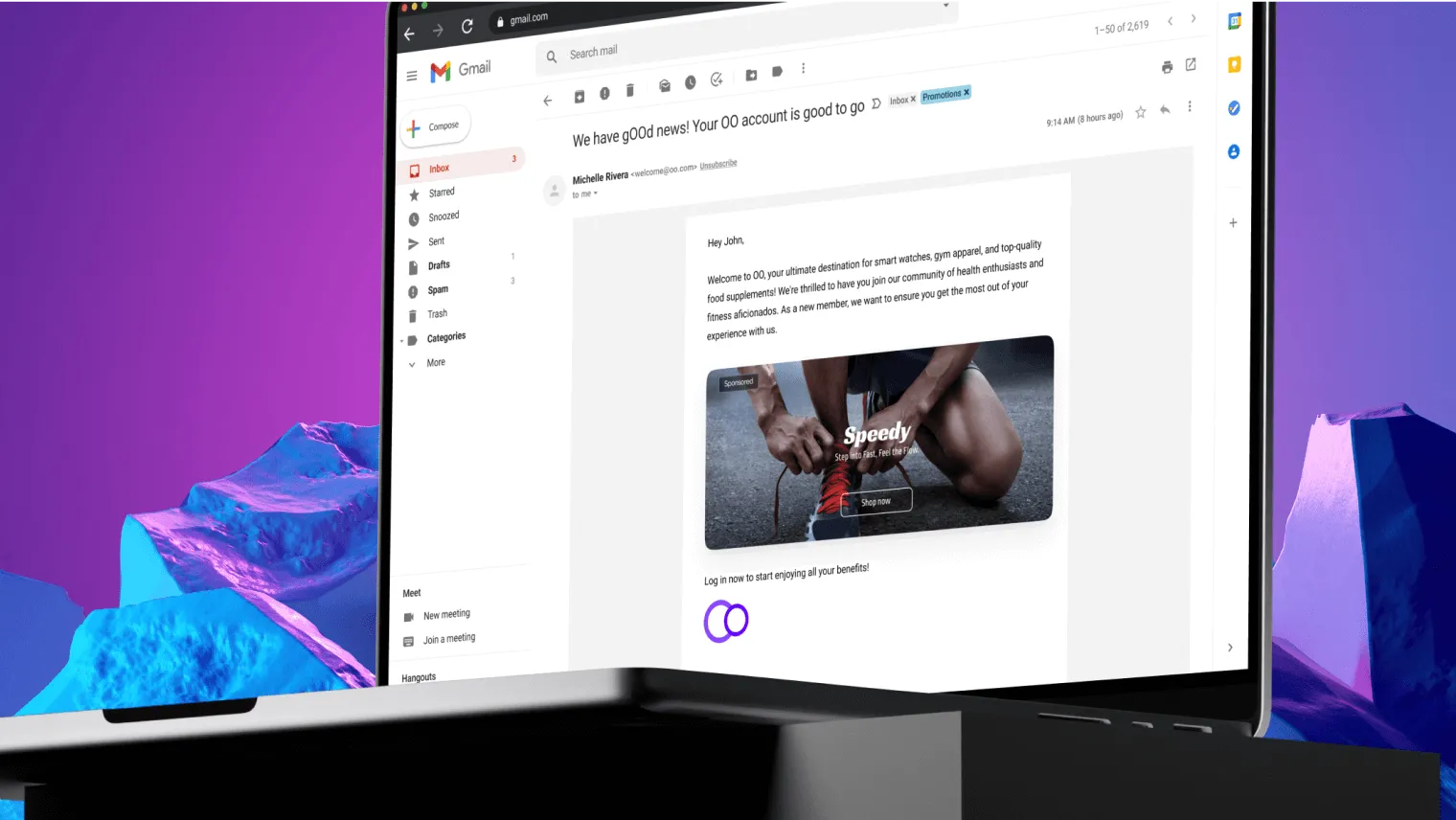

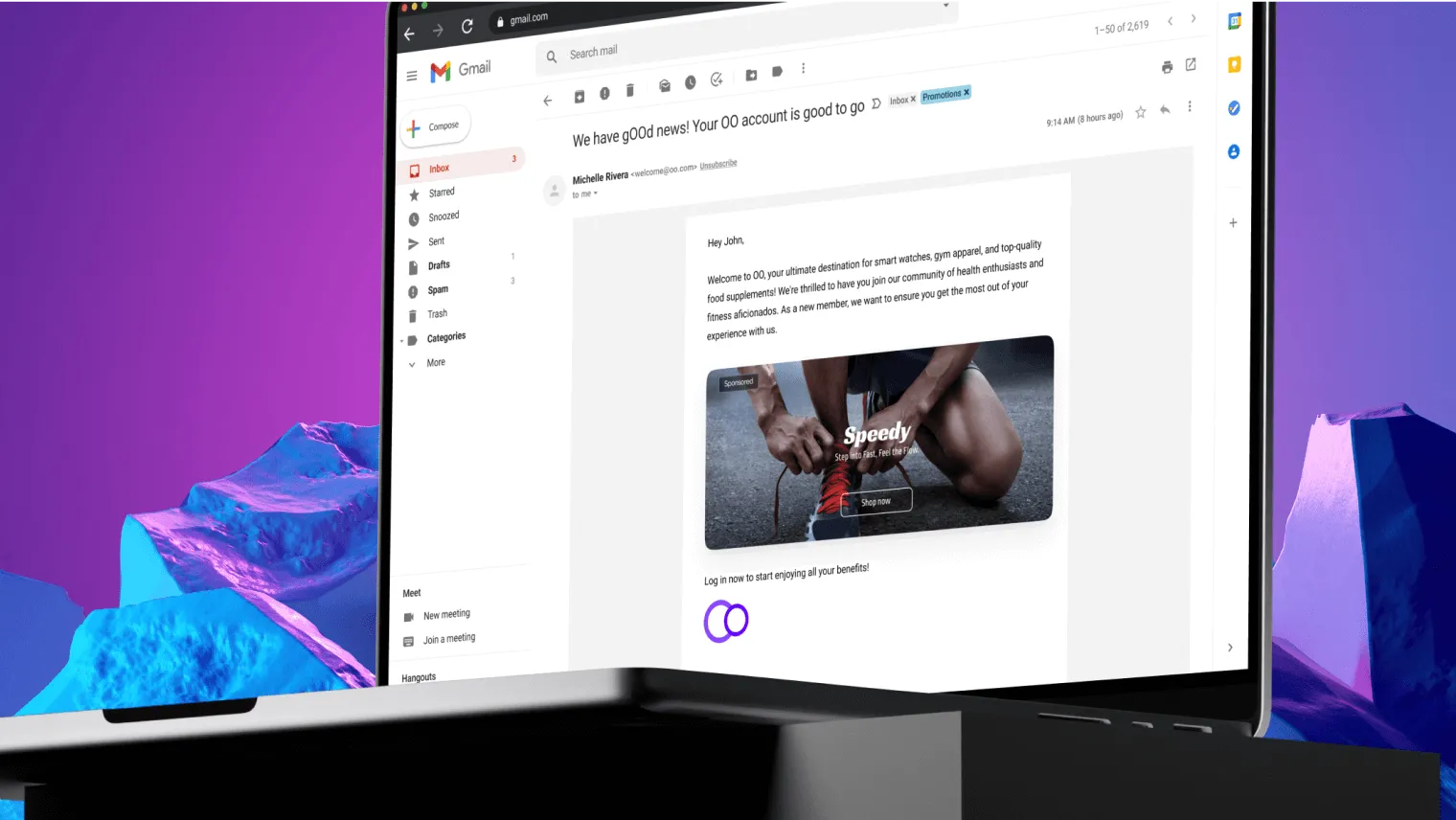

Email Banner

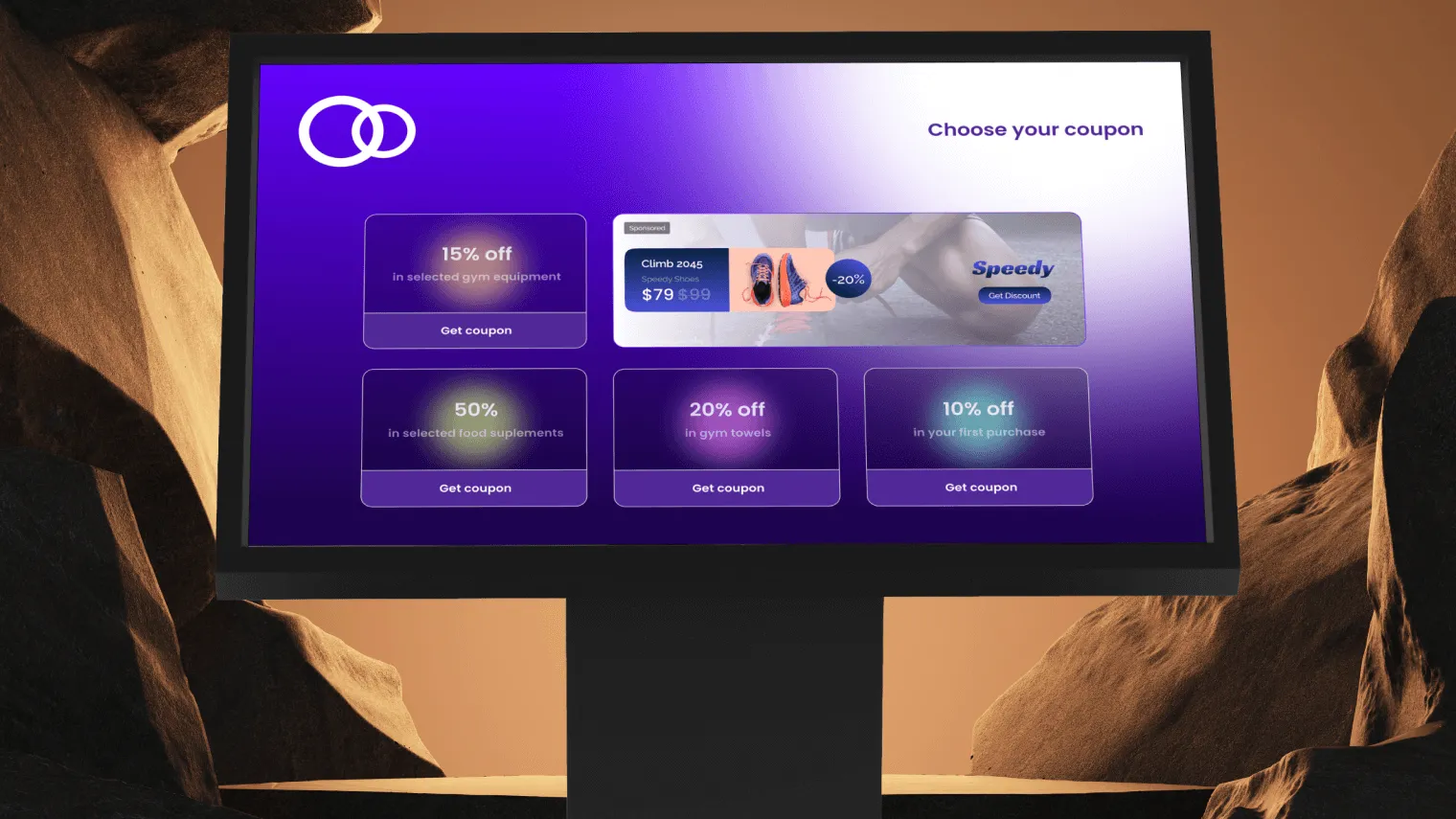

Digital In-Store

.webp)

8598

different ad units powered by Kevel (and counting)

<

50

ms

average p95 latency

0

ads blocked

import adzerk_decision_sdk

# Demo network, site, and ad type IDs; find your own via the Kevel UI!

client = adzerk_decision_sdk.Client(23, site_id=667480)

request = {

"placements": [{"adTypes": [5]}],

"user": {"key": "abc"},

"keywords": ["keyword1", "keyword2"],

}

response = client.decisions.get(request)

print(response)<!DOCTYPE >

<html>

<head>

<title>Kevel Decision API - JavaScript Request</title>

<script type="text/javascript" src="https://unpkg.com/@adzerk/decision-sdk/dist/adzerk-decision-sdk.js"></script>

<script type="text/javascript" src="https://ajax.googleapis.com/ajax/libs/jquery/3.1.1/jquery.min.js"></script>

<script type="text/javascript">

requestNativeAd = function() {

// Demo network, site, and ad type IDs; find your own via the Kevel UI!

let client = new AdzerkDecisionSdk.Client({

networkId: 23,

siteId: 667480

});

let request = {

placements: [{

adTypes: [5]

}]

};

client.decisions.get(request).then(response => {

let decision = response.decisions.div0[0];

// Inject ad contents into page

$("#div0").replaceWith(decision.contents[0].body);

$("#response").text(JSON.stringify(response));

$("#clickUrl").text(decision.clickUrl);

// Record the impression

client.pixels.fire({

url: decision.impressionUrl

});

}).catch(error => {

console.log("ERROR!", error.toString());

});

};

</script>

</head>

<body>

<h1>Kevel Native Ad Request</h1>

<p>Press the button to make an ad request, record the impression, and display both the internal JSON and HTML payload of the response. The response includes data like Impression URL, Click URL, Campaign ID, Metadata, and more. (Note: May not work if you're using an ad blocker).</p>

<button type="button" onclick="requestNativeAd()">Request Ad</button>

<hr />

<h4>Image:</h4>

<div id="div0">

<code>(Nothing yet; please click the button!)</code>

</div>

<h4>JSON Response:</h4>

<code id="response">(Nothing yet; please click the button!)</code>

<h4>Click URL:</h4>

<code id="clickUrl">(Nothing yet; please click the button!)</code>

</body>

</html>package com.adzerk.examples;

import java.util.*;

import com.adzerk.sdk.*;

import com.adzerk.sdk.generated.ApiException;

import com.adzerk.sdk.generated.model.*;

import com.adzerk.sdk.model.DecisionResponse;

public class FetchAds {

public static void main(String[] args) throws ApiException {

// Demo network, site, and ad type IDs; find your own via the Kevel UI!

Client client = new Client(new ClientOptions(23).siteId(667480));

Placement placement = new Placement().adTypes(Arrays.asList(5));

User user = new User().key("abc");

DecisionRequest request = new DecisionRequest()

.placements(Arrays.asList(placement))

.keywords(Arrays.asList("keyword1", "keyword2"))

.user(user);

DecisionResponse response = client.decisions().get(request);

System.out.println(response.toString());

}

}import { Client } from "@adzerk/decision-sdk";

// Demo network, site, and ad type IDs; find your own via the Kevel UI!

let client = new Client({ networkId: 23, siteId: 667480 });

let request = {

placements: [{ adTypes: [5] }],

user: { key: "abc" },

keywords: ["keyword1", "keyword2"]

};

client.decisions.get(request).then(response => {

console.dir(response, { depth: null });

});require "adzerk_decision_sdk"

# Demo network, site, and ad type IDs; find your own via the Kevel UI!

client = AdzerkDecisionSdk::Client.new(network_id: 23, site_id: 667480)

request = {

placements: [{ adTypes: [5] }],

user: { key: "abc" },

keywords: ["keyword1", "keyword2"],

}

pp client.decisions.get(request)(ns example-ad-request

(:import (com.adzerk.sdk Client ClientOptions)

(com.adzerk.sdk.generated.model DecisionRequest Placement User)))

(defn -main []

; Demo network, site, and ad type IDs; find your own via the Kevel UI!

(let [client (Client. (doto (ClientOptions. (int 23)) (.siteId (int 667480))))

request (doto (DecisionRequest.)

(.placements [(doto (Placement.) (.adTypes [5]))])

(.keywords ["keyword1" "keyword2"])

(.user (doto (User.) (.key "abc"))))

response (-> client (.decisions) (.get request))]

(println response)))curl -H 'Content-Type:application/json' \

-X POST \

-d '{"placements":[{

"divName":"div1",

"networkId":23,

"siteId":667480,

"adTypes":[5]}],

"user":{"key":"abc"}}' \

\

https://e-23.adzerk.net/api/v2Ready to get started?

Talk to one of our experts today. Learn how The Retail Media CloudTM can supercharge your retail media network or review our documention.